AI in Insurance: Smarter Risk and Claims Management

For as long as anyone can remember, insurance has been a reactive business. An accident happens, a claim is filed, a check is cut. It’s a model built on responding to events after the fact. But that’s all changing. Today, AI is enabling a massive shift; from simply paying for losses to proactively anticipating and even preventing them.

This isn’t just about bolting on new technology. It’s a fundamental rewrite of the insurance playbook, using data to build smarter, faster, and genuinely personalized services.

The New Insurance Landscape Driven By AI

The traditional insurance model worked well for decades, relying on historical data to assess risk and set premiums. But two major forces are pushing the industry into a new era. First, customers now expect seamless, on-demand digital experiences. Second, we’re swimming in data from IoT sensors, vehicle telematics, and even social media feeds.

This data explosion is the fuel, and artificial intelligence is the engine. AI gives insurers the power to cut through the noise and turn all that raw information into real, actionable insights. In this new world, being data-driven isn’t a competitive advantage anymore; it’s the cost of entry.

Understanding the Core AI Technologies

Behind all this change are a few key AI technologies. Don’t get bogged down in the jargon; think of them as powerful new tools for your team.

- Machine Learning (ML): This is where the predictive magic happens. Think of a seasoned underwriter who, after seeing thousands of policies, develops a gut feeling for risky applications. Machine learning does the same thing but on a superhuman scale. It can analyze millions of data points to find subtle patterns humans would miss, predicting outcomes with stunning accuracy.

- Natural Language Processing (NLP): This is the technology that lets computers understand human language. In practice, it means AI can instantly read and make sense of unstructured text like claim notes, customer emails, and adjuster reports. It’s like having a tireless analyst who can sort and categorize documents around the clock, freeing up your team for more complex work.

These are the foundational components behind modern insurance software solutions. The market growth tells the story: the global AI in insurance market was valued at $4.59 billion in 2022 and is expected to rocket to $79.86 billion by 2032. As detailed in market analysis from Binariks.com, this incredible jump shows just how essential AI has become.

By adopting AI, insurers aren’t just making old processes a bit more efficient. They’re building an entirely new operational model—one that’s more attuned to customer needs, sharper in its risk assessment, and far more effective in how it delivers service.

Making this transition requires more than just good technology; it requires a partner who gets both the tech and the unique demands of the insurance industry. As your expert AI solutions partner, we’re here to help you put these tools to work and build a more resilient, profitable future.

How AI Is Actively Reshaping Core Insurance Operations

When you get past the hype, you find that AI is becoming a real workhorse in the insurance industry. By plugging intelligent systems into their daily operations, insurers are doing more than just making small tweaks; they’re fundamentally overhauling how they do business. This is about breaking through old bottlenecks, cutting down on human error, and creating real value from start to finish.

The changes are most obvious in four key areas where AI is already making a serious impact.

Precision Underwriting at Scale

Underwriting has always been a mix of art and science, a delicate balance between historical data and an underwriter’s gut feeling. The problem is, that traditional model is getting overwhelmed by the sheer amount and variety of data available today. AI is changing the entire equation. Think of it as a super-powered analytical engine that can size up risk with a level of detail we’ve never seen before.

Instead of just looking at the usual demographic stats, AI models can chew through thousands of variables in real time. We’re talking about telematics data streaming from a car, satellite images of a property, or even public records. By spotting subtle patterns and connections that a human analyst would miss, AI helps insurers price risk with surgical precision. The game is shifting from lumping people into broad risk pools to creating truly individual assessments.

Before AI: An underwriter spends hours, sometimes days, manually sifting through an application. They rely on a pretty limited set of data to approve or deny a policy and set a premium. It’s slow, and it’s easy to miss the finer details.

After AI: An AI model instantly cross-references the application with thousands of external data points, spitting out a comprehensive risk score in seconds. This frees up the human underwriters to use their expertise on the really tricky cases, leading to smarter pricing and getting policies issued faster than ever.

Automated Claims Processing

Let’s be honest: the claims process has always been a major headache for everyone involved. It’s a swamp of paperwork, manual inspections, and frustrating delays. AI-powered automation is turning this weeks-long ordeal into a process that can be over in minutes.

For example, computer vision allows an AI to look at photos and videos of a dented car or a damaged roof, instantly calculate the extent of the loss, and estimate what the repairs will cost. At the same time, Natural Language Processing (NLP) can read and understand claim forms, police reports, and customer emails, pulling out the important info and flagging it for review. This tag-team approach doesn’t just speed things up; it also helps cut down on fraud and lets claims adjusters focus on the human side of things—empathy and complex problem-solving.

Proactive Fraud Detection

Insurance fraud is a massive, multi-billion dollar problem that ends up costing everyone more. Traditional detection methods are often like playing catch-up; they’re reactive and usually only spot the most blatant scams. AI flips the script by constantly scanning for suspicious activity, acting as a proactive defense.

Machine learning algorithms can analyze huge, interconnected webs of claims, policies, and third-party data to spot anomalies and fraud rings that would otherwise fly under the radar. An AI system might, for instance, flag a network of clinics that are all submitting strangely similar claims or identify a person who has a history of questionable claims with different insurance companies. This gives fraud investigation teams a critical head start, allowing them to step in early and prevent major losses. Building robust insurance software solutions with these kinds of fraud detection tools baked right in is essential for a modern defense.

Hyper-Personalized Customer Journeys

People today expect interactions to be personal and seamless, and insurance is no exception. AI is what allows insurers to finally deliver on that promise by tailoring every single customer interaction. AI-powered chatbots can handle common questions 24/7, giving customers instant answers. Meanwhile, smarter recommendation engines can suggest the right coverage based on a person’s actual life events—like buying a house or having a baby—and their unique risk profile.

This isn’t just a “nice-to-have.” This kind of personalization builds real loyalty and keeps customers from shopping around. By taking routine tasks off their plates, AI also empowers human agents to become true advisors for more complex situations. If you’re looking to bring this to life, working with expert AI development services can make sure it’s done right. Ultimately, the goal is to create an experience that feels both incredibly efficient and deeply human.

To bring it all together, here’s a look at how these technologies are being applied across the entire insurance business.

Key AI Applications Across the Insurance Value Chain

This table breaks down how specific AI technologies are applied to different stages of the insurance lifecycle, from product development to claims settlement.

| Insurance Function | AI Technology Applied | Key Business Impact |

|---|---|---|

| Product Development | Machine Learning, NLP | Analyzes market trends and customer feedback to design more relevant insurance products. |

| Marketing & Sales | Predictive Analytics, NLP | Identifies high-intent prospects and personalizes marketing campaigns for better conversion. |

| Underwriting & Pricing | Machine Learning, Computer Vision | Assesses risk with greater accuracy using diverse data sources for fairer, more precise pricing. |

| Policy Administration | Robotic Process Automation (RPA) | Automates routine administrative tasks like policy renewals and updates, reducing errors. |

| Claims Processing | Computer Vision, NLP | Speeds up damage assessment and claim validation, leading to faster settlements. |

| Fraud Detection | Anomaly Detection, Network Analysis | Identifies suspicious patterns and organized fraud rings in real-time, saving millions. |

| Customer Service | Chatbots, Recommendation Engines | Provides 24/7 support and personalized advice, dramatically improving customer experience. |

As you can see, AI isn’t just a single tool for a single problem. It’s a flexible set of capabilities that can be woven into every part of an insurer’s operations to drive tangible business results.

Current AI Adoption Rates and Future Industry Trends

The insurance industry has moved past the “what if” stage with AI. It’s now deeply embedded in core operations, and the real question is no longer if insurers are adopting AI, but how and where they’re getting the best results. We’re seeing a clear, decisive shift across the sector toward intelligent automation and genuinely data-driven decisions.

The numbers tell the story. AI is already here in a big way, with 92% of health insurers, 88% of auto insurers, 70% of home insurers, and 58% of life insurers using it today. Looking forward, 78% of insurance leaders are set to increase their tech budgets in 2025. A massive 36% are allocating the biggest slice of that pie specifically to AI—that’s more than they’re spending on big data or cloud infrastructure. As this growth continues, it’s worth exploring the evolving landscape of AI regulation in insurance to stay ahead of compliance.

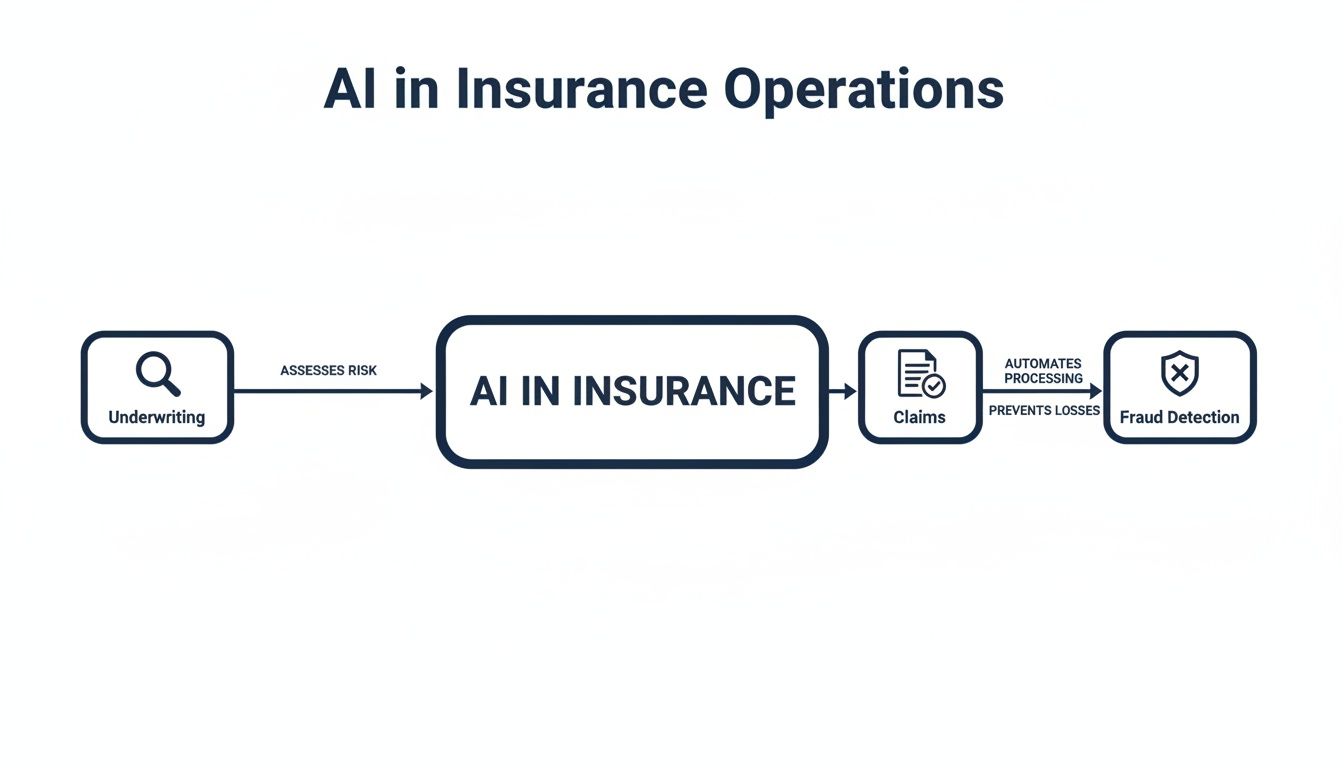

This flowchart maps out how AI is being threaded through the entire insurance value chain, from the first risk assessment all the way to a final claim settlement.

As you can see, AI acts as a smart layer, boosting efficiency and precision at every critical point in the insurance lifecycle.

The Next Wave of AI Innovation in Insurance

So, what’s next? While a lot of the current focus is on making old processes faster and smarter, the future of AI in insurance is about building completely new capabilities. Three trends, in particular, are poised to reshape the industry from the ground up.

- Generative AI for Communication and Creation: Think about instantly drafting perfectly compliant policy documents or generating personalized, empathetic email replies to tricky customer questions. Generative AI is turning this into reality, slashing time spent on administrative work while elevating the quality and consistency of every interaction.

- IoT for Real-Time Risk Adjustment: The explosion of Internet of Things (IoT) devices is a game-changer. Data is constantly streaming in from vehicle telematics, smart home sensors, and wearables. AI algorithms can crunch this live data to adjust risk profiles dynamically, making it possible to reward safer driving or proactive home maintenance with better premiums, right now.

- Predictive AI for Loss Prevention: This is where things get truly exciting. Instead of just reacting to a claim after a disaster, predictive AI models can spot at-risk properties or policyholders and suggest ways to prevent a loss before it ever happens. For instance, an AI could analyze satellite imagery, property specs, and weather patterns to warn a homeowner about a serious flood risk, then recommend specific actions to take before the storm rolls in.

Bridging the Gap from Adoption to Strategic Implementation

Plenty of insurers have successfully run AI pilot programs. The real hurdle, though, is taking those small wins and scaling them across the entire organization. Moving from a few isolated projects to an enterprise-wide AI strategy that actually works requires serious planning, a solid data foundation, and the right expertise.

The gap between initial adoption and full-scale strategic implementation is where many organizations falter. True transformation happens when AI moves from a departmental tool to a core component of the business operating model, influencing decisions from the C-suite to the front lines.

This is often where bringing in professional AI development services makes all the difference. An experienced partner can help you navigate the tricky parts—data governance, model deployment, workflow integration—and make sure your AI investments deliver real, sustainable value. By building a strategic roadmap, insurers can go from just keeping up with trends to actively defining the future of their industry.

Your Practical Roadmap for AI Implementation

Bringing AI into your insurance operations isn’t like flipping a switch. It’s more like laying the groundwork for a new highway—it requires a clear destination, a solid foundation, and a step-by-step plan to make sure everything connects just right. Let’s walk through the five phases that will take you from a promising idea to real, measurable business impact.

Pinpoint High-Value Opportunities

Your first move has nothing to do with the tech. It’s all about your business. Forget chasing the latest AI buzzword and instead, start by identifying the biggest points of friction in your day-to-day operations. Where are the bottlenecks? What’s driving up costs? Where are customers getting frustrated?

Zero in on problems where a solution offers the biggest bang for your buck. Some great places to start are:

- Claims Processing: Think about automating the intake and initial review of simple claims. This can free up your adjusters’ time by 30-40%, letting them focus on the complex cases that really need their expertise.

- Underwriting Support: Imagine an AI tool that pulls and organizes all the necessary data for your underwriters. You could slash policy issuance times and get a more accurate picture of risk.

- Customer Service: An intelligent chatbot handling common questions can dramatically cut down on call center traffic and get customers answers instantly.

Choosing the right first project is everything. To help you find the most fertile ground, it’s worth looking into what’s involved in a proper AI readiness assessment. It’s a process that lines up your data, workflows, and business goals to find that perfect starting point.

Build a Robust Data Strategy

Here’s a hard truth: AI models are only as smart as the data they’re trained on. Data is the fuel for your AI engine. Without a clean, consistent supply, you’re going nowhere fast.

This means you need a solid data strategy. You have to establish clear rules for data quality, make sure the right people can access it securely, and break down the walls between departments. When data from claims, underwriting, and marketing can talk to each other, you get a powerful, unified view of your business. Investing in modern data infrastructure—whether in the cloud or on-premise—isn’t just a good idea; it’s non-negotiable.

Move from Pilot to Production

With a use case picked out and your data in order, it’s time to start small. A pilot project is your test flight. The goal is to prove the concept works, deliver some quick wins, and learn a ton in the process. A successful pilot builds the internal momentum you need to go bigger.

But here’s where many initiatives get stuck. The real challenge isn’t just building a pilot; it’s scaling it. Taking an AI model from a controlled test environment to a live production system is a huge leap that requires serious planning around integration, security, and ongoing performance monitoring.

This transition from a cool experiment to a reliable, enterprise-grade system is a common stumbling block. It’s often where the deep experience of a partner who specializes in custom software development proves its weight in gold, ensuring your solution is built to handle the pressures of the real world.

Integrate AI into Existing Workflows

A brilliant piece of tech creates zero value if no one uses it. For your teams to actually embrace new AI tools, they need to fit seamlessly into the way they already work. Don’t force them to toggle between a dozen different screens.

For example, an AI-generated risk score should pop up right inside the underwriter’s main dashboard. An automated claims summary should be instantly available in the same claims management system your adjusters live in all day. The trick is to make AI feel like a smart assistant that makes their job easier, not another complicated process to learn.

Measure ROI and Continuously Improve

Finally, you have to know what success looks like. Before you even write a line of code, define your Key Performance Indicators (KPIs). These are the metrics that will prove the value of your AI investment and tell you where to focus your efforts next.

For an AI in insurance project, strong KPIs might include:

- Operational Efficiency: Shorter claim processing times, fewer underwriting review cycles.

- Cost Reduction: Lower operational overhead, a measurable drop in fraud-related losses.

- Customer Satisfaction: A higher Net Promoter Score (NPS), faster resolution of customer questions.

- Business Growth: An increase in policy sales, better customer retention rates.

Remember, implementing AI isn’t a one-and-done project. It’s a continuous loop: you deploy, you measure, you learn, and you iterate. That’s how you keep finding new ways to drive more and more value for the business.

Navigating AI Challenges and Ethical Considerations

Bringing AI into the insurance world is much more than a simple tech upgrade. It’s a fundamental shift in how we do business, and it comes with a new set of responsibilities. While the potential is huge, jumping in requires a clear-eyed look at the hurdles ahead, from data privacy and regulatory minefields to the tricky problem of algorithmic bias. Getting this right is crucial for building trust with customers and regulators alike.

There’s no denying the momentum. By 2025, AI had shot to the top of the IT priority list for insurers. A study from Digital Insurance found that 78% of leaders were boosting their tech budgets, with 36% funneling the largest chunk directly into AI.

But here’s the reality check: Conning’s research shows that while 55% of US insurers are experimenting with Generative AI, a mere 7% have managed to scale their systems across the company. This tells us we’re in a critical “growing up” phase, where figuring out the challenges is the main event.

The Challenge of Algorithmic Bias

An AI model is a mirror of the data it’s trained on. If your historical data contains hidden biases—like pricing policies differently for certain zip codes that happen to correlate with race or income—the AI will not only learn those biases, it will amplify them. This can easily lead to discriminatory decisions in underwriting and claims, creating a perfect storm of regulatory and reputational risk.

The only way to fight this is with strict data governance and constant model monitoring. The objective isn’t just accuracy; it’s fairness. This means actively hunting down and rooting out bias at every step, as we explored in our guide on the principles of responsible AI.

Data Privacy and Regulatory Compliance

AI systems are hungry for data, and in insurance, that data is deeply personal. This puts privacy and security front and center. Insurers have to thread the needle through a tangled web of regulations like GDPR and CCPA, which have strict rules about how customer data is handled.

A data breach isn’t just a technical glitch. It’s a profound violation of trust that can permanently scar a brand. Airtight security protocols and transparent data policies aren’t optional—they’re the cost of entry.

On top of that, making sure these systems are reliable is key. That means putting strong strategies for reducing hallucinations in LLM in place to guarantee the outputs are accurate and trustworthy for insurance tasks.

The Human Element and Workforce Transformation

Let’s be clear: AI is changing jobs, not just eliminating them. While algorithms are great at handling repetitive, data-heavy tasks, they can’t replicate human empathy, nuanced problem-solving, or true strategic insight. The future isn’t about replacement; it’s about collaboration.

A successful AI rollout depends entirely on upskilling your team to work with their new digital colleagues. Agents, underwriters, and claims adjusters will need training to understand what the AI is telling them and how to use those insights to make better, more informed decisions. It’s a human-centric approach that empowers your people and, ultimately, delivers far more value to your customers.

How to Select the Right AI Development Partner

Your journey into AI in insurance will hinge on the expertise you bring to the table. Choosing the right technology partner is arguably the single most important decision you’ll make. This isn’t just about hiring coders; it’s about finding a strategic ally who gets the nuances of both artificial intelligence and the insurance world.

A true partner brings more than just technical chops. They act as your guide, steering you away from common pitfalls and making sure your investment delivers real, measurable business value. Our past client cases show how the right team will help you align the technology with your strategic goals, turning a complex project into a clear path toward innovation.

Evaluating Potential Partners

When you start talking to potential partners, your evaluation needs to go much deeper than a flashy capabilities presentation. You should focus on three critical areas that separate an average vendor from a genuine strategic asset.

- Proven Industry Experience: Do they have a real track record in the insurance sector? A partner who already understands the regulatory minefield, core operations like underwriting and claims, and the unique data challenges in insurance will get you to the finish line faster and more reliably.

- Deep Technical Expertise: Look for a team with demonstrable skills in the specific AI disciplines you need, whether that’s machine learning, natural language processing (NLP), or computer vision. Their talent should be obvious, proving they can build robust, scalable systems that actually fit into your existing infrastructure.

- Collaborative and Strategic Approach: The best partnerships are built on open collaboration. Your partner should do more than just build what you ask for; they should provide strategic guidance. This means helping you pinpoint the highest-impact use cases, define clear KPIs, and map out a phased plan for implementation and scaling over time.

A partner’s value is measured not just by the quality of their code, but by their ability to ask the right questions, challenge assumptions, and keep the project squarely focused on business outcomes.

Ultimately, picking a partner is about finding a team that can translate the promise of AI into tangible results. To ensure a smooth transition from an idea to a live system, it’s worth learning more about the specifics of AI integration consulting and how that process shapes a successful project. With the right ally on your side, you can confidently navigate the complexities of AI and build a more intelligent, resilient insurance operation.

Frequently Asked Questions about AI in Insurance

As AI in insurance becomes more common, a lot of questions pop up about what it actually means for the day-to-day business. Getting clear on these points is crucial for any company figuring out its next move. Here are the answers to some of the questions we get asked most often by leaders in the industry.

What is the biggest impact of AI on insurance?

The single biggest change is how AI shifts the entire insurance model from being reactive to proactive. Traditionally, insurance has always been about paying for a loss after something bad happens. AI completely flips that on its head. It gives insurers the tools to actually predict risk, help prevent claims before they happen, and connect with customers in the moment.

This proactive approach creates huge efficiencies on the back end – think automated claims and hyper-accurate underwriting – while also delivering a much more personal experience for the customer. It changes the core job of an insurer from simply being a financial safety net to being an active partner in helping customers live safer, less risky lives. This isn’t just a small improvement; it’s a total redefinition of the insurance industry’s role.

How can smaller insurers get started with AI?

For smaller insurers, the trick is not to try and boil the ocean. A massive, company-wide overhaul is usually the wrong way to go. The smart move is to start with a focused, high-impact project that solves a real, specific business problem. This approach gets you a measurable win quickly and builds the confidence and momentum you need for bigger projects down the road.

A couple of great places to start are:

- AI-Powered Chatbots: Setting up a chatbot to handle basic customer service questions can almost immediately lighten the load on your call center and get customers answers faster.

- Focused Data Analytics: You could use a targeted AI tool to sharpen risk assessment for just one line of business. This can improve your underwriting accuracy without having to disrupt the entire department.

Starting small gives your team a chance to learn and adjust. This build-as-you-go method is a fundamental part of a successful journey toward using AI for your business.

Will AI replace insurance agents?

No, AI is poised to become an agent’s best tool, not their replacement. The technology is fantastic at handling the repetitive, data-heavy tasks that eat up so much of an agent’s time right now. By taking over the routine administrative work, AI frees up human agents to double down on what they do best.

This means spending more time building solid client relationships, offering advice on complex situations, and providing the kind of strategic support that requires real empathy and human understanding. In this partnership, AI works like a powerful co-pilot, feeding agents the data-driven insights they need to serve their clients even better.

What are the key risks of implementing AI in insurance?

While the upside is huge, bringing AI into your operations comes with real risks that you have to manage carefully. The biggest concerns revolve around data bias baked into the algorithms. If you’re not careful, this can lead to unfair or discriminatory outcomes in everything from pricing to claims decisions.

Beyond that, data privacy and security are massive issues, since AI systems often need access to a ton of sensitive customer information. And of course, trying to keep up with the complicated and constantly changing world of regulatory compliance is another major hurdle. Tackling these risks head-on requires a solid ethical framework and a real commitment to transparency, as we explored in our guide on the principles of responsible AI.

Ready to see what intelligent technology can do for your insurance operations? At Bridge Global, we specialize in building custom AI solutions that boost efficiency, cut down on risk, and create truly great customer experiences. Let’s discuss how our AI development services can give you a competitive edge.