Smart Insurance Tech

Whether you're looking to enhance risk assessment, automate claims, or improve customer experiences, Bridge Global offers tailored solutions that fit your needs. From AI integration to custom software development, we bring deep domain expertise and an agile approach to help insurers modernize operations and drive real business value.

Meet the Minds Behind the Mission

Solving Insurance Challenges With AI

Customer Service Is Costly and Slow

Routine inquiries drain valuable resources. Download our whitepaper to see how AI can solve this and improve customer response efficiency.

Policy Recommendations Lack personalization

Generic policy suggestions miss individual needs. Download our whitepaper to learn how AI can personalize this.

Underwriting Is Manual and Resource-Draining

Traditional underwriting causes inconsistencies. Download our whitepaper to see how AI can streamline this.

Getting Started with AI:

Our Approach

AI adoption in insurance is still in its early stages, but companies that start now will lead the industry into a data-driven future. At Bridge Global, we combine domain expertise with an agile mindset to guide you every step of the way, whether you're experimenting or ready to scale.

AI Use Case Workshop

Identify impactful AI applications, aligning solutions with your business needs.

Assess feasibility, regulatory requirements, and expected ROI.

Experiments & Coaching

Train teams to leverage AI tools for productivity gains and operational efficiency.

Develop AI adoption roadmaps tailored to your organizational goals.

Proof of Concept & MVP Development

Rapidly prototype and test AI-powered solutions before scaling.

Validate AI models with real-world datasets to ensure effectiveness.

AI Application Development

Deploy production-ready AI applications that deliver measurable results.

Integrate AI seamlessly with existing insurance IT infrastructure.

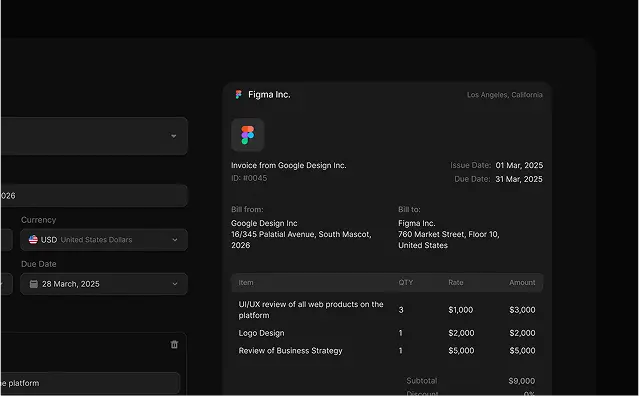

Success Stories

Here’s how we’ve helped insurance teams strengthen their tech where it matters most.

Let’s Talk AI for Insurance

Whether you're exploring AI or looking to modernize your operations, we help insurance providers enhance underwriting, streamline claims, and boost customer satisfaction. From intelligent automation to tailored digital solutions, we bring the right technology to meet your business goals.