AI in the Insurance Industry: Your Guide to Transforming Operations

Look at the future of insurance, and you’re looking right at artificial intelligence (A). AI is no longer just a buzzword; it’s becoming the core engine of the industry, completely changing the business model from one of simply paying claims to one that actively predicts and prevents risk.

The New Era Of AI-Driven Insurance

Artificial intelligence is triggering a massive shift away from the traditional, manual processes that have defined insurance for decades. We’re moving toward a far more dynamic, data-centric world. Instead of relying on static historical data tables and an underwriter’s gut feeling, insurers can now use AI to analyze immense streams of information as it happens.

This opens up a world of possibilities: hyper-personalized policies, automated decisions that take seconds instead of days, and a significant boost in both operational efficiency and customer trust.

This isn’t just a future-state concept; it’s happening now and the market is exploding. The global AI in insurance market was valued at around $4.59 billion in 2022 and is forecast to hit nearly $79.86 billion by 2032. That’s a compound annual growth rate (CAGR) of over 30%, which points to a massive, industry-wide race to adopt this technology. You can dig into more data on the AI in insurance market to see the full picture of this incredible growth.

Where AI Is Making The Biggest Impact

To understand how AI is changing the game, it’s helpful to see where it’s being applied across the core functions of insurance.

Below is a quick comparison of the old way versus the new, AI-powered approach.

Key AI Applications Transforming Insurance

| Core Insurance Function | Traditional Approach | AI-Powered Transformation |

|---|---|---|

| Underwriting & Pricing | Manual review of applications and static actuarial tables. | Dynamic risk assessment using real-time data from IoT, telematics, and external sources for more precise, personalized pricing. |

| Claims Processing | Slow, paper-based, and manual claim submission and verification, often taking weeks. | Automated claims intake and damage assessment using computer vision and NLP, reducing processing time from weeks to minutes. |

| Fraud Detection | Rule-based systems and manual investigation by human analysts. | Machine learning models that detect complex, evolving fraudulent patterns in real-time, saving billions in losses. |

| Customer Experience | Call centers with long wait times and generic, one-size-fits-all communication. | AI-powered chatbots for 24/7 support, personalized product recommendations, and proactive risk-mitigation advice. |

These applications aren’t just about doing the same things faster; they’re about creating entirely new capabilities and a more intelligent way of managing risk.

The real change is moving from a reactive model to a proactive one. Insurers can now anticipate customer needs, offering advice and coverage that genuinely fits their lives as they change.

Making this leap requires a clear plan and the right expertise. As we’ve covered in our guide on AI readiness, getting your organization prepared is the critical first step.

Many insurers find that working with an experienced AI solutions partner is the most direct path to a successful transition. Tapping into specialized AI development services allows you to build powerful insurance software solutions that deliver tangible results and a real competitive edge.

How AI Is Reshaping Core Insurance Processes

Artificial intelligence isn’t just a shiny new tool; it’s fundamentally rewiring the engine room of the insurance industry. By plugging directly into core functions, AI is swapping out slow, manual work for fast, data-driven decisions. This shift is hitting hardest—and delivering the most value—in four key areas that define the insurance journey, from writing a policy to paying out a claim.

Whether it’s assessing risk, processing claims, stopping fraud, or just talking to customers, AI brings a new level of speed and precision to the table. Getting this right means building sophisticated systems, which often calls for deep expertise in custom software development and creating dedicated insurance software solutions that can handle the complexity.

Supercharging Underwriting with Data

Underwriting has always been a mix of art and science, leaning heavily on historical data and the gut instinct of an experienced professional. AI tips the scales firmly toward science, enabling a far more detailed and dynamic way to assess risk. Machine learning algorithms can chew through thousands of data points in real time—a scale no human team could ever match.

Think beyond the usual application form. We’re talking about new, alternative data sources like:

- Telematics data from a car that reveals actual driving habits.

- IoT sensor data from a smart home that can flag a water leak before it becomes a disaster.

- Satellite imagery that shows a property’s real-time exposure to wildfire or flood risk.

By crunching this mountain of information, AI models can price policies with surgical precision, making sure the premium someone pays is a true reflection of their personal risk. This isn’t just better for the bottom line; it allows insurers to create fairer, more customized products for their customers.

By moving beyond static actuarial tables, insurers can offer hyper-personalized policies that truly resonate with customers, shifting the relationship from a simple transaction to a trusted partnership in risk management.

Automating Claims Processing from Weeks to Hours

For decades, the claims process has been a major headache for customers. It’s a world of endless paperwork, manual reviews, and agonizing waits for a payout. AI-powered automation is completely turning this experience on its head.

In auto insurance, for example, a customer can now just snap a few photos of a dented fender with their phone. A computer vision algorithm gets to work instantly, assessing the damage, estimating the repair cost, and in some cases, approving the claim in minutes. At the same time, Natural Language Processing (NLP) can scan police reports and medical records, pulling out the key facts without anyone having to lift a finger. This kind of automation can slash operational costs by up to 70% and makes customers a lot happier by delivering a quick, transparent resolution when they need it most.

Proactive Fraud Detection and Prevention

Insurance fraud is a multi-billion-dollar problem. The old-school, rule-based systems might catch the most obvious fakes, but they’re easily outsmarted by more sophisticated schemes. Here, AI provides a massive upgrade. Machine learning models can spot suspicious patterns and hidden connections across millions of claims—things a human analyst would almost certainly miss.

These systems are always learning from new data, getting smarter with every claim they see. They can flag everything from a slightly exaggerated repair bill to a highly organized fraud ring. The technology is also getting more advanced, incorporating things like AI-driven biometric fraud reduction to add powerful new layers of verification. As we explored in our guide on data analytics in financial services, the ability to find the needle of fraud in a haystack of data is one of AI’s greatest strengths.

Enhancing the Customer Experience

Finally, AI is changing the very nature of how insurers and policyholders interact. Chatbots and virtual assistants now offer 24/7 support, answering routine questions, helping customers manage their policies, or walking them through the first steps of filing a claim. It’s the kind of instant, on-demand service that people have come to expect.

But it goes deeper than just support. AI unlocks true hyper-personalization. By understanding a customer’s data, an insurer can proactively suggest better coverage, send safety alerts based on real-time risks (like an impending hailstorm), and craft a journey that feels like it was designed for one person. This builds incredible loyalty and repositions the insurer as a genuine partner in protecting what matters most.

Measuring the Business Value and ROI of AI

Beyond the impressive tech, what really matters is the impact AI in the insurance industry has on the bottom line. It’s time to move from the ‘what’ to the ‘why’—the real business benefits and return on investment (ROI) that artificial intelligence brings to the table. This isn’t just about modernizing your systems; it’s about building a smarter, more profitable, and more resilient insurance business.

A solid AI strategy isn’t just an experiment. When done right, it produces concrete financial gains you can actually see on a balance sheet.

From Better Data to Stronger Profits

One of the clearest paths to ROI starts with underwriting. AI models can chew through thousands of data points—far more than any human team ever could—to build incredibly accurate risk profiles. This level of precision allows insurers to price policies with confidence, making sure the premium truly matches the risk.

This leads to two huge financial wins:

- Improved Risk Selection: You can confidently greenlight profitable policies while sidestepping those with hidden, high-cost risks that might have slipped through before.

- More Profitable Portfolios: Over time, a book of business built on precise risk assessment is simply more stable and generates better returns.

This data-first approach drastically cuts the odds of major underwriting losses and builds a far more sustainable business model.

Driving Down Operational Costs

Automation is where AI really shines in terms of efficiency. Think about all the manual, repetitive work in claims processing—it’s not just slow, it’s expensive. AI-powered automation tackles this problem head-on, delivering some serious cost savings.

By automating routine claims intake, verification, and even initial damage assessment, insurers can slash claims processing costs by as much as 30%. This frees up your skilled adjusters to focus on the complex, high-value cases that actually need a human touch.

These efficiency gains go beyond just labor costs. They dramatically speed up how quickly you can settle a claim, which cuts down on all the administrative baggage that comes with long, drawn-out cases. Faster, more accurate processing is a direct line to a healthier bottom line. For those looking to get started, you might be interested in our guide on implementing AI in business, which outlines a strategic approach.

Quantifying the Impact of Fraud Reduction

Insurance fraud is a multi-billion-dollar headache for the industry. AI is one of the most powerful tools we have to fight back, and the return is crystal clear. AI fraud detection systems have shown a 65% improvement in their ability to spot suspicious activity, cutting fraud-related overpayments from 10% down to just 4%. We’re talking about a massive reduction in financial leakage.

The industry is moving fast because the results speak for themselves. By 2025, around 77% of insurers in major markets are expected to have some form of AI in place, chasing the tens of billions in potential savings from smarter fraud prevention alone.

The Value of a Superior Customer Experience

Finally, let’s not forget the value of customer satisfaction and loyalty. It might be harder to plug into a spreadsheet, but its long-term impact is undeniable. AI-powered chatbots and personalized communications make for a smoother, faster, and more responsive experience for your customers.

A great experience builds loyalty and reduces churn, which is a critical metric for profitability. Happy customers are more likely to renew, buy other products from you, and recommend you to their friends and family. This positive cycle of retention and referral is a powerful engine for long-term business growth.

Building a Robust Technical and Data Foundation

You can’t build a skyscraper on a shaky foundation, and the same is true for implementing AI in your insurance business. Before a single algorithm can start delivering value, you have to get the groundwork right. That all starts with a smart data strategy that puts governance, quality, and security first, right from the get-go.

High-quality, well-organized data is the fuel for any AI system. If your data is messy, inaccessible, or irrelevant, even the most powerful models will fall flat. That’s why insurers need to establish clear data governance policies to make sure information is managed responsibly, protecting its integrity while staying on the right side of regulations like GDPR.

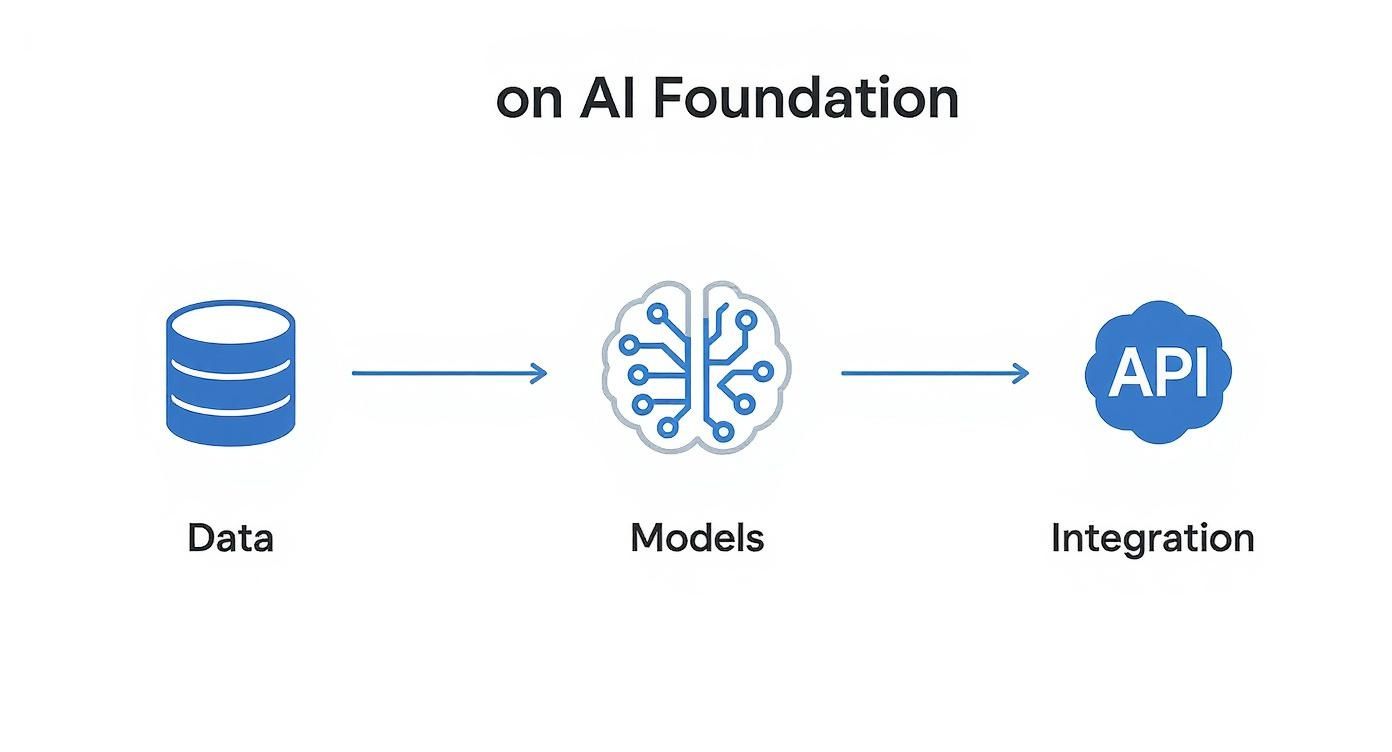

Integrating AI with Core Systems

Let’s be honest: most insurance companies are running on complex legacy systems that were never built for the world of AI. Trying to connect modern AI tools to this older infrastructure is a major technical hurdle, and it’s one that requires serious architectural planning. You can’t just “plug in” an AI solution; it takes a thoughtful strategy to make the new and the old work together.

The most successful integration approaches usually involve a mix of these patterns:

- APIs (Application Programming Interfaces): Think of these as translators. They create a bridge that lets modern AI tools talk to your core policy administration or claims management platforms without a hitch.

- Microservices Architecture: Instead of trying to overhaul a massive, monolithic system, this approach breaks it down into smaller, independent services. This makes it much easier to add new AI-powered features without bringing the whole system to its knees.

- Cloud Infrastructure: Platforms like AWS, Azure, or Google Cloud give you the raw computing power and flexible storage you need. Training and running sophisticated AI models is demanding, and the cloud provides the scalable engine to do it effectively.

Getting this architectural blueprint right ensures your AI solutions are not just powerful today, but also resilient, scalable, and easy to maintain down the road.

A well-designed technical architecture is the central nervous system for your AI. It ensures insights flow smoothly from your data to your decision-makers, without creating bottlenecks or disrupting the workflows your team relies on.

Selecting the Right AI Models and Tools

The term “AI” is a huge umbrella, and picking the right tool for the job is absolutely critical. Not every problem needs a massive, complex deep learning model. The trick is to match the technology to the specific insurance task you’re trying to solve. As we’ve covered before, assessing your company’s AI readiness is a crucial first step in understanding what you’re capable of.

For instance, classic machine learning models are often the perfect fit for predicting customer churn or flagging high-risk policies using the structured data you already have. On the other hand, deep learning and neural networks really shine when you’re dealing with unstructured data—think using computer vision to assess photos of vehicle damage or Natural Language Processing (NLP) to make sense of an adjuster’s handwritten notes.

To build genuinely intelligent systems that can draw from vast internal knowledge bases, you’ll need to understand more advanced techniques. For a deeper dive into the mechanics, a practical guide to Retrieval Augmented Generation (RAG) provides an excellent technical overview.

Putting all these pieces together is a highly specialized skill. This is where finding an expert partner for AI development services can make all the difference. The right partner helps you navigate the technical maze, from choosing the best models to engineering an enterprise-grade architecture that delivers real business results while keeping you compliant. They ensure the foundation you build is ready not just for today, but for whatever innovations come next.

Navigating Implementation Challenges and Driving Adoption

Bringing AI into an insurance company isn’t just a tech project; it’s a fundamental shift in how your entire organization operates. You need a solid game plan. While the promise of AI is huge, the road to get there is often bumpy, with obstacles popping up around people, processes, and even ethics. A successful rollout depends almost entirely on a smart change management strategy that gets everyone on board, from the executive team to the underwriters on the front lines.

This is a serious undertaking, which is why AI has shot to the top of the IT priority list for insurers worldwide. We’re seeing 78% of insurance leaders boosting their tech budgets, and a massive 36% of that new spending is going directly into AI projects. This isn’t just tinkering; it’s a major financial commitment to overcome the very real challenges of adoption, as detailed in these insights on the new insurance landscape.

Overcoming Key Implementation Hurdles

To get AI right, you have to face the common roadblocks head-on. Most of them fall into a few predictable buckets: getting your people ready, untangling the technical knots, and making sure you’re using AI responsibly.

- Closing the Skills Gap: Your team is your biggest strength, but they can’t work with AI if they don’t know how. The answer is focused training. You need programs that build data literacy and teach people how to partner with AI tools, not just use them. This turns employees from spectators into confident users who understand what the algorithms are telling them.

- Managing Expectations: Let’s be clear: AI isn’t a silver bullet. It’s critical to set realistic timelines and define exactly what success looks like from the start. A tight, well-defined proof-of-concept (POC) is a great way to show early value and get everyone excited. This keeps the C-suite and the claims adjusters all on the same page.

- Building Ethical AI and Rooting Out Bias: Insurance is built on trust. You absolutely have to create strong governance to keep an eye on your models and prevent algorithmic bias. This means regular audits, being transparent about how decisions are made, and always having a “human-in-the-loop” for complex or sensitive judgments.

This diagram illustrates the basic flow: data feeds the models, and those models are then integrated into your daily operations to drive better decisions.

As you can see, everything starts with a clean data foundation. Without that, even the most powerful models will struggle to deliver real value.

Rolling out any new technology, especially one as impactful as AI, is bound to hit some snags. Here’s a look at the most common challenges we see and how to get ahead of them.

Common AI Implementation Challenges and Solutions

| Challenge | Potential Impact | Strategic Solution |

|---|---|---|

| Data Quality & Accessibility | Inaccurate models, biased outcomes, and poor decision-making. Garbage in, garbage out. | Invest in a data governance framework. Implement data cleansing processes and create a unified “single source of truth” for key datasets. |

| Legacy System Integration | Delays, budget overruns, and siloed systems that prevent AI from accessing critical data. | Adopt an API-first strategy. Use middleware to connect old systems with new AI platforms, and prioritize a phased modernization plan. |

| Employee Resistance & Fear | Low adoption rates, active pushback, and a failure to realize the technology’s full potential. | Focus on change management. Communicate the “why” behind the change, provide robust training, and involve employees in the design process. |

| High Initial Costs | Strain on IT budgets, difficulty securing C-suite buy-in, and pressure for immediate ROI. | Start small with a high-impact POC. Clearly define business value and KPIs upfront to build a strong business case for further investment. |

| Regulatory & Compliance Risks | Fines, reputational damage, and loss of customer trust due to privacy violations or biased algorithms. | Establish an AI ethics board. Build “explainability” into models and conduct regular audits to ensure compliance with regulations like GDPR. |

By anticipating these issues, you can build a more resilient and effective implementation strategy from day one.

A Practical Roadmap for Driving Adoption

A clear, step-by-step approach can turn anxiety into excitement. The idea is to make this feel like a natural evolution for your company, not a jarring revolution. As an experienced AI solutions partner, we’ve seen this strategy work time and time again.

The secret is to treat AI implementation as a change management initiative first and a technology project second. When people understand the ‘why’ and are equipped with the ‘how,’ adoption follows naturally.

Start by putting together teams with people from different departments—IT, business unit leaders, and frontline staff. This ensures the solutions you build are actually practical for the people who will be using them every day. By sharing lessons from our client cases, we can show you how other insurers have successfully navigated this path, turning big challenges into even bigger opportunities.

What’s Next for AI in the Insurance World?

We’ve already seen AI make some serious waves in insurance, but what’s on the horizon is even more exciting. We’re moving beyond just predicting what might happen and stepping into an era of real-time risk management and personalization so precise it feels like it’s straight out of a sci-fi movie.

Thinking about these future trends is key to building an AI strategy that won’t be obsolete in a year. This isn’t just about speeding up old processes; it’s about inventing entirely new ways of doing business and connecting with customers.

The Dawn of Continuous Underwriting

Think about this: what if your insurance policy wasn’t a static document you sign and forget? What if it was alive, adapting to your life as it changes? That’s the core idea behind continuous underwriting, where a risk profile is constantly updated in real time.

This living, breathing policy is fed by a steady stream of data from all sorts of places:

- IoT Sensors: A smart smoke detector in a client’s home could instantly communicate its status, potentially lowering their premium for having that extra layer of protection.

- Telematics: Instead of waiting a year for a good driver discount, safe driving habits tracked by a car’s telematics system could adjust rates on a monthly, or even weekly, basis.

- Wearable Technology: Life and health policies could reward a healthy lifestyle by factoring in data from wearables, turning insurance into a partner in personal wellness.

This approach makes insurance feel fairer and more relevant to each person’s actual situation. Pulling this off requires some serious data engineering, which is where our experience in custom software development for insurers really comes into play.

Generative AI and Hyper-Personalization

Generative AI is set to completely change how insurers talk to their customers. Imagine crafting policy summaries, risk reports, or even safety tips that are uniquely written for one specific customer and their circumstances. That’s now possible.

Even more interesting is its ability to create high-quality synthetic data. This lets insurers train their AI models on vast, realistic datasets without ever touching sensitive customer information—a massive step forward for ethical and responsible AI.

The future of insurance lies in embedded, invisible protection. AI will enable coverage to be seamlessly integrated into the products and services people use every day, offering protection at the precise moment it’s needed.

Embedded and Parametric Insurance Models

Finally, AI is the powerhouse behind two models that are quickly gaining ground: embedded and parametric insurance.

- Embedded Insurance: This is all about baking insurance right into another purchase. Our work building custom eCommerce solutions has shown us just how much customers love this seamless experience. Think of automatically adding travel insurance when you book a flight—no extra forms, no hassle.

- Parametric Insurance: This is insurance at its simplest. It pays out a predetermined amount automatically when a specific event happens, like a hurricane hitting a certain wind speed. AI is the magic ingredient here, processing data from satellites and sensors in real time to trigger these payouts instantly.

Frequently Asked Questions About AI in Insurance

How is AI used in the insurance industry?

AI is used across the entire insurance lifecycle to drive efficiency and accuracy. Key applications include AI-powered underwriting for more precise risk assessment, automated claims processing using computer vision and NLP, advanced fraud detection with machine learning, and personalized customer experiences through chatbots and data-driven recommendations.

What are the benefits of using AI in claims processing?

AI dramatically accelerates claims processing, reducing it from weeks to hours or even minutes. It automates manual tasks like data entry and damage assessment, which lowers operational costs by up to 30%. This leads to faster payouts, higher customer satisfaction, and allows human adjusters to focus on more complex cases.

Can AI completely replace human underwriters and claims adjusters?

No, AI is a tool to augment human expertise, not replace it. It handles repetitive, data-heavy tasks, freeing up professionals to focus on complex, nuanced, and strategic decisions that require human judgment, empathy, and critical thinking. The goal is a collaborative model where humans and AI work together for better outcomes.

What is the biggest challenge when implementing AI in insurance?

The biggest challenge is often data-related. Many insurers struggle with data quality, accessibility, and integrating modern AI platforms with legacy systems. Overcoming this requires a strong data governance framework and a clear strategy for modernizing IT infrastructure. Additionally, managing organizational change and ensuring ethical AI use are critical hurdles.

Ready to see what AI can do for your insurance business? At Bridge Global, we build intelligent, scalable software solutions that deliver real-world results. From an initial AI Discovery Workshop to full-scale implementation, we’re the technology partner you need to make your digital transformation a success. Connect with us now.