AI in Insurance Underwriting: Smarter Risk Management

For years, insurance underwriting was more of an art form than a precise science. It relied on the seasoned intuition of human experts who would manually sift through applications, study historical loss data, and ultimately make an educated guess on how to price a policy. It was a system that worked, but it was also incredibly slow, labor-intensive, and limited by how much information one person could possibly analyze.

This old-school approach often created frustrating bottlenecks. Quotes were delayed, policies took too long to bind, and the customer experience suffered. The inherent complexities, like trying to nail down a car’s actual cash value after a total loss, show just how much room for error there was in these manual calculations.

From Educated Guesses to Data-Driven Certainty

This is where AI in insurance underwriting comes in, fundamentally changing the game. We’re moving away from static, backward-looking data and embracing a dynamic, predictive model. Instead of just looking at an application form, AI algorithms can pull in and make sense of a constant flow of information from dozens, even hundreds, of sources. This gives underwriters a much richer, more forward-looking picture of risk, turning the entire process into a predictive engine.

This isn’t some far-off future concept; it’s happening right now. The industry is rapidly adopting these tools. A recent survey revealed that 92% of health insurers and 88% of auto insurers are already using AI, a clear signal that intelligent automation is the new standard.

By shifting underwriting from a reactive, manual chore to a proactive, automated workflow, insurers can price risk with incredible accuracy, slash operational costs, and offer a much better experience to their customers.

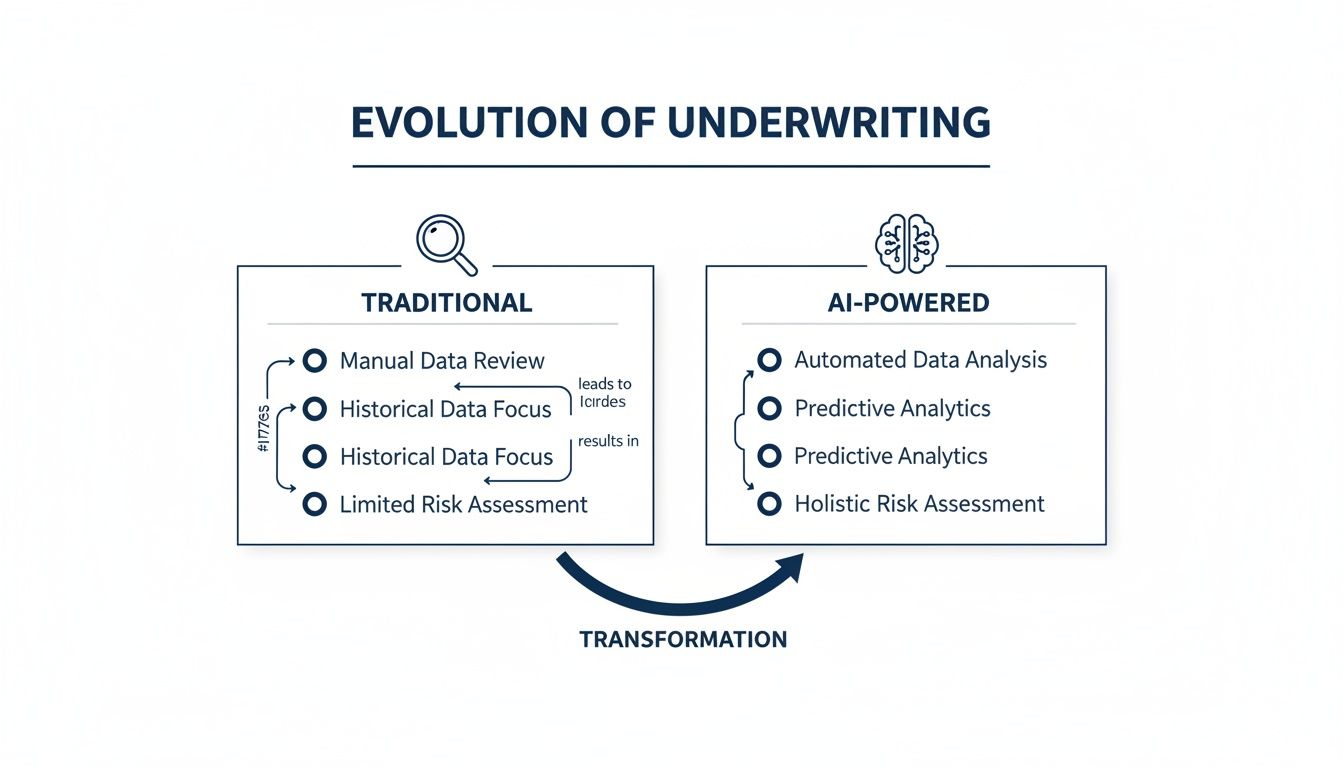

How AI Changes the Game: A Side-by-Side Look

To really grasp the difference, let’s compare the old way with the new. The table below breaks down how AI reimagines every core aspect of the underwriting process.

Traditional Underwriting vs AI-Powered Underwriting

| Attribute | Traditional Underwriting | AI-Powered Underwriting |

|---|---|---|

| Data Sources | Limited to applications, credit reports, and MVRs. | Expansive; includes telematics, IoT, satellite imagery, social data. |

| Process Speed | Slow, manual review taking days or weeks. | Near-instantaneous, real-time decisions. |

| Risk Assessment | Based on historical data and generalized risk pools. | Predictive, based on individualized, real-time risk factors. |

| Decision-Making | Subjective, reliant on underwriter experience and judgment. | Objective, data-driven, and highly consistent. |

| Customer Experience | Lengthy application processes, long wait times for quotes. | Fast, seamless digital experience with quick approvals. |

| Efficiency | Labor-intensive, high operational costs. | Highly automated, reducing manual effort and costs. |

As you can see, the move to AI isn’t just an upgrade. It’s a complete overhaul that delivers tangible benefits across the board, from internal efficiency to customer satisfaction.

Making this transition is no small feat, though. It demands a clear strategy and a deep well of technical knowledge. For many, bringing in an experienced AI solutions partner is the key to getting it right. A good partner can help you build powerful insurance software solutions that not only streamline your operations today but also give you a serious competitive edge for years to come.

How AI Actually Learns to See and Predict Risk

When we talk about AI in insurance underwriting, it’s easy to picture a sci-fi robot making decisions. The reality is much more practical. Think of AI less as a single “brain” and more as a powerful toolkit of specialized algorithms. Each tool is designed to sift through mountains of data, spot patterns a human might miss, and make predictions at incredible speed. It’s not about consciousness; it’s about sophisticated math and statistics, just scaled up massively.

At its heart, AI learns by consuming and interpreting information. This process fundamentally changes underwriting from a backward-looking review of historical data to a dynamic, forward-looking assessment. The goal is to build a complete, real-time picture of risk that is constantly being refined.

The Core Engines of AI Underwriting

Two main technologies really drive most AI underwriting systems: predictive analytics and Natural Language Processing (NLP).

Think of predictive analytics as an incredibly advanced weather forecast, but for insurance claims. It crunches countless variables, everything from a driver’s typical braking habits to historical storm patterns in a specific zip code, to calculate the probability of a future event, like a car crash or property damage. As we explored in our guide on how predictive analytics can transform your business, this lets insurers price policies with a level of precision that was previously impossible.

Natural Language Processing (NLP), on the other hand, acts like a superhuman assistant who can read and understand text. It can instantly scan thousands of documents, from broker emails and medical reports to complex property deeds, and pull out the critical details an underwriter needs. This automates the tedious, manual grind of document review, freeing up your human experts to focus on the tricky, high-stakes decisions that require their judgment.

An AI doesn’t just look at an application; it contextualizes it. It connects disparate data points to form a cohesive narrative about a potential policyholder’s risk profile, moving from simple data entry to deep risk story analysis.

This concept map really brings home the evolution from the old way of doing things, with its limited data inputs, to the holistic, AI-driven approach.

As you can see, it’s a clear shift from manual, siloed analysis to an integrated system where AI weaves together diverse data streams into a complete risk picture.

Expanding the Data Universe

The real magic of AI is unleashed by the sheer variety of data it can make sense of. Traditional underwriting was stuck with a small set of standard documents. Modern AI systems cast a much wider net, pulling in valuable information from all sorts of alternative sources.

- Telematics and IoT Data: Getting data directly from a car’s onboard diagnostics (like speed and braking patterns) or smart home sensors (smoke detectors, water leak monitors) offers a direct, real-time view of behavioral risk.

- Satellite and Drone Imagery: For property insurance, AI can analyze high-resolution images to assess roof conditions, check a property’s proximity to wildfire zones, or track changes over time—often without a single physical inspection.

- Public and Social Data: AI can analyze publicly available information, like online business reviews or social media trends, to help gauge reputational risk for commercial policies or spot emerging market patterns.

- Unstructured Text: This is a goldmine. It includes everything from an underwriter’s handwritten notes and customer service emails to detailed loss-run reports, all of which NLP can process to find hidden insights.

By blending these new data streams with traditional sources, AI constructs a multidimensional risk profile that is far more accurate and nuanced than anything that came before.

The Real-World Payoff of AI in Underwriting

While the technology behind AI is fascinating, what really matters is the tangible impact it has on the business. Bringing AI into underwriting isn’t just a tech upgrade; it’s a strategic overhaul that delivers measurable returns in efficiency, risk management, and the customer experience.

The first thing you’ll notice is a massive leap in speed. AI takes over the tedious, repetitive work—sifting through documents, collecting data, and running initial checks. This frees up your experienced underwriters from the administrative grind, letting them focus on the complex, high-stakes cases where their judgment truly counts.

Slashing Costs and Boosting Productivity

Think about the old way of doing things. A single policy could get stuck in the pipeline for days, even weeks, bogged down by manual data entry and endless back-and-forth. AI completely rewrites that timeline.

An intelligent system can digest an entire application in minutes. This acceleration means underwriters can process a much higher volume of submissions without compromising the quality of their decisions. As we’ve detailed in our guide on calculating the real ROI of AI projects, these efficiency gains are where you see the immediate value.

Sharpening Risk Selection and Profitability

AI underwriting is smarter. By analyzing huge, diverse datasets like telematics or satellite imagery, the models can spot subtle patterns and risk indicators that a human might miss. This gives you a far more nuanced and accurate picture of each applicant.

This newfound precision directly improves your most important metrics:

- Better Loss Ratios: When you get better at picking good risks and sidestepping bad ones, you naturally pay out less in claims.

- Smarter Pricing: AI allows for dynamic pricing that reflects the true risk of each policy, keeping you competitive without sacrificing profitability.

- Less Fraud: Algorithms are incredibly good at flagging weird patterns in application data that often point to fraud, letting your team investigate before it’s too late.

For instance, this level of precision can directly influence things like commercial truck insurance rates by creating a pricing model that’s both fair and backed by solid data.

Gaining a Competitive Edge with a Better Customer Experience

In a crowded market, how you treat your customers can make all the difference. The speed and precision of AI underwriting create a noticeably better experience for applicants.

By streamlining the underwriting process, AI enables insurers to deliver quotes in minutes instead of days, creating a seamless and satisfying journey for applicants that builds loyalty from the first interaction.

That speed-to-quote is a game-changer. It’s what modern customers expect, and it’s often the reason they’ll choose you over a competitor. Add in the ability to offer personalized products tailored to an individual’s unique situation, and you’ve built a powerful competitive advantage.

The numbers back this up. Industry studies show that AI and automation can drive a 10–15% increase in premium growth and cut new-customer onboarding costs by 20–40%. The value of AI isn’t some far-off promise; it’s here now, helping insurers improve their bottom line and strengthen their position in the market today.

AI in Insurance Underwriting: Real-World Examples

It’s one thing to talk about the theory, but seeing AI in action is where you grasp its real impact on the insurance world. Across the board, from auto to property to life insurance, intelligent systems are no longer just a concept. They’re actively reshaping how insurers understand and manage risk, leading to more accurate, responsive, and personalized coverage.

Let’s look at a few examples of how this technology is being used in the real world to turn abstract data into smart underwriting decisions.

Auto Insurance: The Shift to Usage-Based Models

For years, auto insurance pricing relied on static, indirect indicators of risk—things like your age, credit score, and past driving record. But Usage-Based Insurance (UBI), which is fueled by AI and telematics, is flipping that model on its head.

Instead of generalizing, AI models analyze real-time data directly from a driver’s car or smartphone. They look at actual driving habits: speed, acceleration, braking patterns, and even the time of day a person is on the road. This creates a dynamic, individual risk profile, allowing insurers to offer premiums that truly reflect how safely someone drives.

This creates a clear win-win:

- For Insurers: It means more precise risk selection and pricing, which helps cut losses from high-risk drivers who might have been miscategorized before.

- For Drivers: Safe drivers are rewarded with lower premiums. This not only saves them money but also encourages safer roads and builds customer loyalty.

Property Insurance: Getting Ahead of Risk

In property insurance, especially for homes in areas hit by natural disasters, AI is becoming a powerful early warning system. Rather than depending on old property records or occasional site visits, insurers are now using AI to analyze high-resolution satellite and drone imagery.

An AI model can sift through thousands of images to spot emerging risks with stunning accuracy. It can flag overgrown brush near a home in a wildfire zone or identify subtle signs of roof damage before a major hailstorm rolls through. This kind of proactive underwriting, a key part of modern insurance software solutions, lets insurers collaborate with policyholders to fix problems before a claim ever needs to be filed.

This move from just reacting to claims to proactively preventing losses is one of the biggest benefits of AI. It stops disasters before they happen, lowers costs for everyone, and forges a stronger, more trusting relationship between the insurer and the policyholder.

Health and Life Insurance: Truly Personalized Underwriting

The health and life insurance sectors are also getting a data-driven upgrade. AI algorithms are now capable of securely analyzing massive datasets, from electronic health records (EHRs) to voluntary data shared from wearables like smartwatches.

This gives underwriters a much richer, more individualized view of a person’s health. An AI model can see lifestyle patterns and health trends that paint a far more accurate picture of long-term risk than a simple questionnaire ever could. The result is a faster, less invasive underwriting process that produces fairer, more personalized policies. As our own client cases demonstrate, applying AI correctly solves these kinds of real-world business problems.

Getting Past the Hurdles of AI Adoption

AI holds incredible promise for insurance underwriting, but let’s be realistic: it’s not a simple plug-and-play solution. Getting it right means carefully navigating some significant ethical and practical challenges. The goal is to build systems that aren’t just effective, but also fair, transparent, and compliant.

This measured, thoughtful approach is at the core of how we build custom software. We focus on creating AI solutions that are powerful, yes, but also trustworthy and secure. It’s about turning governance from a chore into a real strategic advantage.

The Black Box Problem and Why Explainability Matters

One of the biggest conversations in AI right now revolves around the “black box” problem. Some of the most powerful machine learning models can spit out incredibly accurate predictions, but they can’t tell you how they reached that conclusion. For a heavily regulated industry like insurance, that’s a deal-breaker.

Regulators—and your customers—need to know why a decision was made, especially if it’s a denial or a higher premium. This is where Explainable AI (XAI) comes into play. XAI is a set of tools and techniques designed to peel back the layers of an AI model and give you clear, human-understandable reasons for its decisions.

An insurer can’t just shrug and say, “The algorithm decided.” You have to be able to trace and justify every decision. It needs to be auditable, fair, and defensible. This isn’t just about checking a compliance box; it’s about earning and keeping customer trust.

Facing Down Algorithmic Bias

AI models are products of the data they learn from. If that historical data reflects old biases, even unintentional ones, the AI will not only learn them. It might even make them worse.

Think about it: if past underwriting practices accidentally linked certain zip codes with protected demographic groups, an AI trained on that data could continue that pattern, leading to discriminatory pricing. This can happen even if you’ve carefully removed the sensitive data fields.

Tackling this requires a proactive game plan:

- Scrutinize Your Data: Before you even start building a model, you have to comb through your training data to find and correct any hidden historical biases.

- Conduct Fairness Audits: Don’t just set it and forget it. Regularly test your models to make sure their outcomes are fair and equitable across different customer segments.

- Keep Humans in the Loop: Always have a system for human oversight. An expert underwriter should be able to review and, if necessary, override an automated decision that doesn’t pass the common-sense test.

Data Privacy and Security Are Non-Negotiable

AI-powered underwriting is hungry for data, and much of that information is deeply personal and sensitive. Protecting it is job number one. Insurers absolutely must have rock-solid data governance frameworks in place to comply with regulations like GDPR and CCPA.

This goes way beyond just having secure servers. It means strict controls on who can access the data, using techniques like anonymization, and having clear rules for how data is handled during model training and in day-to-day operations.

A single data breach can result in massive fines and can permanently damage your company’s reputation. Before jumping in, it’s wise to take a hard look at your internal capabilities, as we covered in our guide to assessing your organization’s AI readiness and maturity. Clearing these hurdles is what separates a successful AI initiative from a failed one, allowing you to unlock the real, lasting value of AI in your underwriting.

Your Roadmap to AI-Powered Underwriting

Making the switch to an AI-driven underwriting model is a big move, but it doesn’t have to be a painful one. The key is to break the journey down into clear, manageable phases. This approach lets you de-risk the process, show real value early on, and build the momentum needed for a complete overhaul.

Think of it as a practical path from just kicking the tires to a full, enterprise-wide deployment. It all starts with discovery—and I don’t just mean looking at technology. The real first step is identifying the most pressing business problems that AI can actually solve. A focused workshop can help you zero in on high-impact opportunities, like slashing quote times, tightening up loss ratios, or finally automating that soul-crushing document analysis.

Phase 1: The Proof of Concept

Once you’ve locked in a clear use case, it’s time for a Proof of Concept (PoC). Speed and validation are everything here. A PoC is a small, tightly focused project designed to prove one thing: that the AI solution can deliver the results you expect, using your actual data.

For instance, a PoC could be as simple as training a model to pull specific data points from a small batch of submission documents. You’re not trying to build a perfect, shiny system. You’re just answering the critical question: “Does this even work for us?” A successful PoC gives you the hard evidence you need to get stakeholders to open their wallets for the next stage.

Phase 2: The Pilot Program

With a successful PoC under your belt, you’re ready for a pilot program. This is where the rubber meets the road. You’ll test the solution in a controlled, real-world setting, maybe by rolling out the AI tool to a small team of underwriters to handle live submissions.

The pilot is absolutely essential for getting feedback and fine-tuning the model. It shows you how the tool holds up under real operational pressure and what needs to be tweaked before you go big. This cycle of testing and improving is at the heart of any good custom software development project.

Phase 3: Scaling to Full Production

The final stretch is scaling the now-proven solution across the entire organization. This is about more than just flipping a switch on the technology. It means providing thorough training for your teams, rewriting operational workflows, and setting up solid monitoring systems to track performance and stay compliant.

A successful AI implementation isn’t a one-time project; it’s the beginning of a continuous improvement cycle. The models must be regularly monitored, retrained with new data, and adapted to changing market conditions to maintain their accuracy and value.

Ready to get started? Find out how you can put AI for your business to work and begin your underwriting transformation today.

Frequently Asked Questions About AI in Insurance Underwriting

What is the primary role of AI in insurance underwriting?

The primary role of AI in insurance underwriting is to enhance accuracy, speed, and consistency in risk assessment. It moves the process from relying on historical averages to pricing risk based on highly specific, individual data points. By analyzing vast datasets that are beyond human capacity to process, AI identifies critical patterns, leading to more precise pricing, improved loss ratios, and significantly faster quote-to-bind cycles. This ultimately helps insurers create more competitive and profitable products.

Will AI replace human underwriters?

No, the goal of AI is not to replace human underwriters but to augment their capabilities. AI excels at automating repetitive, data-intensive tasks and handling straightforward applications, which frees up human experts to focus on more complex, high-value cases. This creates a powerful partnership where AI acts as a “co-pilot,” handling the analytical heavy lifting while underwriters apply their nuanced judgment, industry expertise, and relationship-building skills to strategic decisions and unique risk scenarios.

How does AI help with fraud detection during the underwriting process?

AI is exceptionally effective at detecting fraud by identifying subtle anomalies and inconsistencies that might otherwise go unnoticed. Machine learning models can analyze patterns across thousands of applications, flagging discrepancies between different documents (like a submission form and a loss report), unusual data combinations, or other red flags indicative of misrepresentation. This allows insurers to investigate suspicious applications proactively, preventing fraud before a policy is even issued.

What is the first step to implementing AI in our underwriting process?

The best way to start is with a clear business objective rather than focusing on technology first. Identify a specific, high-impact problem you want to solve—for example, reducing quote turnaround time for a particular line of business. From there, the recommended approach is to begin with a small-scale Proof of Concept (PoC). Partnering with an experienced AI solutions partner for a PoC allows you to test the technology with your own data, validate its potential value, and build a strong business case before committing to a full-scale implementation.

Ready to see how intelligent automation can reshape your underwriting? At Bridge Global, we build powerful insurance software solutions that are designed to boost efficiency and drive real profitability. Contact us to learn more.