Your Guide to AI Integration in Insurance Transformation

When we talk about integrating AI into insurance, we’re really talking about a fundamental shift. It’s about moving away from the old-school, manual way of doing things like underwriting and claims processing, and toward a smarter, data-driven system. The end game is to make insurance faster, far more accurate, and genuinely personalized for every policyholder. For insurers, this isn’t just a nice-to-have; it’s a must-do to stay in the game.

Why AI Integration Is Reshaping the Insurance Industry

The insurance world has been stuck with slow, paper-heavy systems for decades. Artificial intelligence is the force finally breaking that logjam. And this isn’t some far-off idea; it’s happening right now, completely changing how we assess risk, manage claims, and interact with customers. In today’s market, AI integration in insurance is no longer an option. It’s essential for survival and growth.

This guide is designed to be a practical roadmap. We’ll cut through the buzzwords to show you what AI actually does, from overhauling underwriting to tackling the strategic and ethical hurdles of putting it all into practice.

The Driving Force Behind AI Adoption

The momentum for AI is real, and the investment numbers back it up. A massive $60.8 billion has been invested in insurtech companies since 2012, with a significant $15.2 billion of that going directly to AI-focused innovations. A recent survey really puts this into perspective: 82% of insurers are already using generative AI, which is more than any other industry polled. Better yet, 84% are seeing a positive return on that investment. The value is clearly there.

So, what’s pushing this massive shift? It boils down to a few key benefits:

- Enhanced Operational Efficiency: Automating the repetitive, time-consuming tasks in claims and underwriting frees up your experts to focus on the complex cases where their judgment truly matters.

- Improved Risk Assessment: AI models can sift through enormous datasets to spot subtle risk patterns that a human underwriter might miss, which leads directly to more precise and fair pricing.

- Superior Customer Experience: Think AI-powered chatbots for instant answers 24/7 and communications that feel like they were written just for you. This is what modern customers expect.

- Advanced Fraud Detection: Machine learning algorithms can flag suspicious claims with a level of accuracy and speed that traditional methods simply can’t match.

A New Era of Personalized Insurance

Ultimately, bringing AI into the fold is all about creating an insurance experience that feels more responsive and tailored to the individual. Personalization is what builds customer loyalty. To see how this is already playing out, just look at the ways the industry is embracing technology and personalization in health insurance.

This journey can seem complex, but it’s also incredibly rewarding. The key is having the right partner to help you build solutions that deliver real, measurable business value and unlock everything AI has to offer.

How AI Is Reshaping Core Insurance Operations

Let’s move past the theory and get into what AI actually does for insurance companies. The real story isn’t about adding another piece of tech; it’s about completely rethinking the core jobs that have always been slow and manual. What you get on the other side is an operation that’s faster, smarter, and much more in tune with what customers need.

This isn’t just a minor tweak—it’s creating a massive gap between the insurers who get on board and those who don’t. The insurance sector has actually jumped ahead of most other industries in adopting AI, both for making predictions and creating content. One survey found that a staggering 82% of insurers are already using generative AI in their work, and even better, 84% of them say it’s already delivering a positive ROI.

To see how this all comes together, let’s look at a few key areas where AI is making a tangible difference.

Transforming Underwriting with Data-Driven Precision

Underwriting has always been a slow, painstaking process. It involved digging through historical data and doing manual reviews that could easily stretch into weeks. AI turns that entire model upside down by sifting through thousands of data points in the blink of an eye. We’re talking about everything from car telematics for auto policies to data from a smartwatch for a life insurance application.

Machine learning models are brilliant at finding tiny patterns and risk factors a person would never catch. This lets insurers move from lumping people into broad, generic risk pools to assessing each person’s unique situation. It’s a fundamental shift from reacting to risk to getting ahead of it. And when you look beyond just AI, exploring other strategies for mitigating risk with advanced technologies like digital simulations and IoT only sharpens this advantage.

To really grasp the shift, here’s a breakdown of how AI capabilities are changing the game across the board.

Impact of AI Across Key Insurance Functions

| Insurance Function | AI Capability | Business Impact |

|---|---|---|

| Underwriting | Predictive Analytics, ML Risk Modeling | More accurate risk assessment, personalized pricing, and reduced manual effort. |

| Claims Processing | Computer Vision, Natural Language Processing | Faster claims settlement (from weeks to minutes), lower processing costs, and a better customer experience. |

| Fraud Detection | Anomaly Detection, Network Analysis | Pinpoints complex fraud rings, reduces financial losses, and helps maintain fair premium costs. |

| Customer Service | Chatbots, Virtual Assistants | Provides 24/7 support for routine inquiries, freeing up human agents for complex, high-value issues. |

This table illustrates that AI isn’t a single solution but a set of powerful tools that can be applied to solve specific, long-standing problems in each core area of the business.

Accelerating Claims Processing and Settlement

For most customers, filing a claim is the moment of truth. It’s often a stressful time, and a slow, confusing process can ruin a relationship. This is where AI delivers some of its most impressive wins. It can automate the entire claims journey, from the first notification all the way to payment.

Think about it from the customer’s perspective. Someone gets into a minor fender-bender and uses their phone to submit a claim. In the background, AI can:

- Analyze photos of the damage to immediately assess how bad it is and estimate the cost of repairs.

- Cross-reference policy details and scan for any red flags that might suggest fraud.

- Approve and process the payment for a simple, clear-cut claim in a matter of minutes.

This isn’t just about saving the company money on administrative costs. It’s about delivering speed and clarity right when your customer needs you the most.

Detecting Fraud with Unmatched Accuracy

Insurance fraud is a multi-billion dollar problem that drives up costs for everyone. The old way of catching it—manual reviews and simple rules—just can’t keep up with sophisticated schemes. AI, however, is a different story. It uses machine learning to comb through claims data, spotting strange patterns and outliers that scream “fraud.”

AI is exceptional at connecting the dots. It can find links between seemingly random data—like several different claims coming from the same address or using uncannily similar descriptions. This helps uncover complex fraud rings that would have been invisible before.

The best part is that these systems get smarter over time. They learn from every new claim and adapt to new fraud tactics as they emerge, protecting the company’s finances and keeping premiums more affordable for honest policyholders.

Elevating the Customer Service Experience

Finally, AI is changing the very nature of customer interaction. Chatbots and virtual assistants are now on the front lines, offering 24/7 help with common questions, guiding people through the claims process, or even suggesting policy add-ons.

This kind of instant, always-on service is what people have come to expect. But more importantly, it takes the routine, repetitive questions off the plates of human agents. This frees them up to focus on the complicated, sensitive issues where a human touch—empathy and creative problem-solving—truly makes a difference. By automating the simple stuff, insurers can provide better, more meaningful support where it matters most.

Building Your Strategic AI Integration Roadmap

Any successful AI integration in insurance starts with a clear plan, not just a scramble for the latest tech. Diving into AI without a detailed roadmap is like building a house without a blueprint, you might end up with four walls and a roof, but it won’t be the functional, stable structure you actually need. A strategic approach ensures every AI project is tied directly to a real, measurable business outcome.

The whole process kicks off by asking the right questions. Are you trying to slash operational costs in claims processing? Do you want to elevate the customer journey with instant, personalized support? Or is the main goal to sharpen your risk models for more accurate underwriting? Pinpointing these sharp, achievable goals is the critical first step that guides every single decision that follows.

Establishing Your Data Foundation

Once you know what you want to achieve, the focus has to shift to the bedrock of any AI project: a solid data strategy. Data is the fuel that powers machine learning models. Its quality, accessibility, and governance will absolutely make or break your initiative. Without that solid foundation, even the most sophisticated algorithms are guaranteed to fall flat.

Getting this right involves a few non-negotiable components:

- Data Quality and Cleansing: You have to ensure your data is accurate, complete, and consistent. This often requires a significant upfront effort to clean and standardize years of historical data. It’s not glamorous, but it’s essential.

- Secure Collection and Storage: You need robust systems in place to securely gather and store massive amounts of information—everything from policyholder details to telematics data—while staying compliant with strict privacy regulations like GDPR or CCPA.

- Governance and Accessibility: Clear rules must be established for who can access data and why. Your data science teams need it to be readily available, but it must be locked down to prevent unauthorized use or breaches.

Choosing the Right Integration Model

With a data strategy in motion, the next puzzle piece is figuring out how AI will plug into your existing technology stack. There isn’t a one-size-fits-all answer; the right integration model depends entirely on your specific goals, budget, and technical maturity. This is also where you need to think about MLOps (Machine Learning Operations)—the practices that ensure you can actually deploy and maintain machine learning models in a live environment reliably and efficiently.

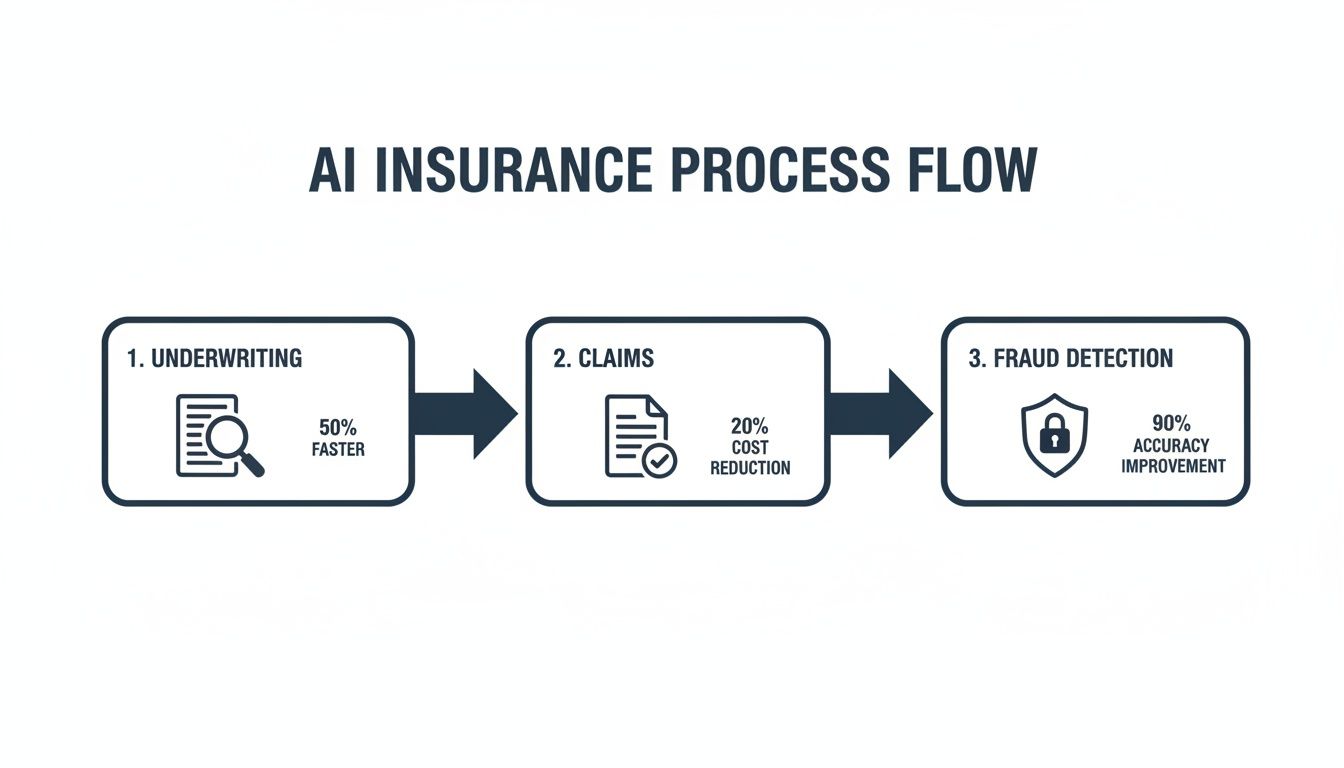

The image below gives a great high-level view of how AI can be woven into the core insurance workflow, from the initial risk assessment all the way to the final claim settlement.

As you can see, AI isn’t just one tool. It acts as an intelligent layer across underwriting, claims, and fraud detection, automating repetitive tasks and surfacing data-driven insights at each critical stage.

Championing a Pilot-First Approach

Honestly, the best way to get started is to think small. Instead of attempting a massive, company-wide overhaul from day one, champion a pilot-first approach. Start with small, manageable projects that can deliver a high impact. This strategy lets you build momentum, prove the value to skeptical stakeholders, and learn crucial lessons in a controlled, low-risk environment.

A successful pilot project serves as a powerful proof of concept. It demonstrates tangible ROI quickly, which helps build organizational buy-in and secures the resources needed for larger, more ambitious AI integrations down the line.

For instance, you could start with an AI model designed to automate the initial sorting and routing of incoming claims. It’s a well-defined problem with a clear metric for success: reduced manual effort and faster customer response times. Once that model proves its worth, you can expand its capabilities or move on to a more complex challenge, like predictive underwriting.

This methodical, step-by-step process is the key to reducing risk and ensuring your AI integration in insurance is built for sustainable, long-term success. As we explored in our guide on implementing AI in your business, this phased approach is critical for success.

Navigating the Ethical and Compliance Landscape of AI

Bringing AI into your insurance operations is more than just a tech project; it’s a huge responsibility. While these powerful algorithms can unlock incredible efficiencies, they also open a Pandora’s box of ethical questions and compliance headaches. To get AI integration in insurance right, you need a governance framework built on trust, transparency, and a non-negotiable commitment to protecting your policyholders.

The stakes couldn’t be higher. Insurers are custodians of some of the most sensitive personal data out there—from health records to financial histories. Any AI system that touches this information must be ironclad, with robust security to prevent breaches and maintain compliance with standards like GDPR and CCPA. A failure here isn’t just a technical glitch; it’s a breach of trust that can trigger massive financial penalties and do lasting damage to your reputation.

Confronting Algorithmic Bias

One of the most insidious dangers lurking in AI is algorithmic bias. If you train a model on historical data that reflects old societal prejudices, the AI will learn and sometimes even amplify those biases. For an insurer, this could mean an underwriting model that unfairly penalizes certain demographics or a claims system that flags their submissions with unwarranted suspicion.

This isn’t just a theoretical problem. A biased model can lead to real-world harm, like higher premiums or denied coverage for people based on factors that have zero to do with their actual risk. Regulators are watching this very closely, and insurers caught using biased AI are facing the real threat of hefty fines and legal battles. You have to get ahead of this, which means:

- Auditing your training data to find and fix any imbalances before they poison your model.

- Constantly testing your models for fairness across different demographic groups.

- Building human-in-the-loop systems so your experts can review and override any questionable AI-driven decisions.

The Mandate for Transparency and Explainability

For decades, insurance decisions were made by people who could, if pressed, explain their thinking. When AI models act like mysterious “black boxes,” that accountability vanishes. This is precisely why Explainable AI (XAI) is no longer a nice-to-have; it’s a fundamental part of deploying AI responsibly.

XAI is really just a set of tools and methods that make an AI model’s decision-making process understandable to a human. It lets you answer the all-important question: why did the model arrive at this conclusion? This is absolutely essential for internal audits, regulatory inquiries, and, most importantly, for building trust with your customers. As we’ve covered in our guide on the principles of responsible AI, you can’t have real accountability without transparency.

An insurer must be able to explain why a premium was set at a certain level or why a claim was denied. Without explainability, you’re not just risking compliance violations—you’re risking your relationship with every policyholder.

This is where working with expert AI development services makes a huge difference, as they can build these ethical guardrails and explainability features into your models from the very beginning.

Balancing Innovation with Regulatory Realities

The rapid push into AI has created a constantly shifting regulatory environment. Take health insurance, for example. A recent NAIC survey across 16 states found that 84% of insurers are already using AI and machine learning for core functions. This isn’t happening in a vacuum; this widespread use is prompting new rules and greater scrutiny.

From the policyholder’s perspective, it’s vital that these new tools are governed by clear ethical guardrails to ensure fairness and protect their data. As a report from Conning points out, while AI is great at spotting threats, its growing use also creates new vulnerabilities that have to be managed. You can learn more about these AI survey findings on Conning.com. Lasting success with AI is ultimately built on a foundation of trust, and that trust is only earned by navigating this complex world with diligence and integrity.

Measuring the True ROI of Your AI Initiatives

So, how do you prove your big AI bet is actually paying off? To keep the budget flowing and justify your strategy, you need a no-nonsense way to measure real returns. This isn’t about vanity metrics; it’s about tying every AI initiative to key performance indicators (KPIs) that directly hit the bottom line. A successful AI integration in insurance isn’t just about cool new tech—it’s about driving tangible business results.

You have to connect the dots between your AI projects and concrete financial and operational wins. For the insurers leading the pack, this is a constant, data-backed conversation that proves the value of their work to everyone from the C-suite to the front lines.

Key Operational and Financial KPIs

To build a business case that gets a “yes,” your measurement plan has to track improvements where it really counts. These metrics draw a straight line from the AI tool to its impact on your company’s efficiency and profitability.

Here’s what you should be watching:

- Claims Processing: Keep a close eye on the average time to settlement. You want to see that number drop. Also, track the percentage of claims that fly through with straight-through processing (STP), meaning no human hands touched them.

- Underwriting Accuracy: Compare the loss ratio on policies priced with your AI models against those done the old way. A lower loss ratio is proof of smarter risk selection.

- Fraud Detection: This one is straightforward. Measure your fraud detection rate and, more importantly, the reduction in fraudulent claim payouts. These are direct savings that clearly show AI’s value as a guardian of the company’s finances.

- Operational Costs: Calculate the cost savings from automation, specifically the reduction in Loss Adjustment Expenses (LAE) and other operational overhead.

Gauging the Impact on Customer Experience

While the operational numbers are vital, don’t forget about the policyholder. In the long run, their experience is what fuels growth. AI should make their interactions with you faster, easier, and fairer.

A great customer experience, powered by AI, is a massive competitive advantage. When service is quick, communication is personal, and outcomes feel fair, you build the kind of trust that stops policyholders from shopping around at renewal.

To put a number on this, you’ll want to track these experience-focused KPIs:

- Customer Satisfaction (CSAT) Scores: Specifically measure CSAT for interactions handled by AI, like a chatbot query or an automated claim update.

- Policyholder Retention Rate: See if there’s a clear link between a smoother, AI-driven claims or service experience and customers sticking with you.

- Net Promoter Score (NPS): An uptick in your NPS is a strong signal that your AI-powered improvements are turning customers into fans.

These metrics prove that AI isn’t just making you more efficient; it’s making you more customer-focused. As we’ve seen in our client cases, top insurers masterfully connect these operational and customer wins to demonstrate the full value of their AI programs. The data tells a consistent story: a better, faster experience builds a stronger, more profitable business.

The financial upside of rewiring operations with AI is huge. Industry reports show real-world benefits like 10-20% boosts in new agent success and sales conversions, 10-15% premium growth, 20-40% slashes in customer onboarding costs, and 3-5% gains in claims accuracy. Those numbers make a pretty compelling case for AI’s direct contribution to your financial health. You can discover more insights about these AI insurance survey findings to see the full picture of the potential returns.

Your Next Steps to Gaining an AI Advantage

We’ve covered a lot of ground on what AI can do for insurance, why it matters, and how it all comes together. Now, it’s time to move from theory to action. Getting started with AI is a journey, not a race, and the best way to finish strong is to start with a clear direction.

The most practical first step is to look inward. Start by auditing your current operations to find the biggest headaches AI could solve. Where are the real bottlenecks in your claims process? Which parts of underwriting still feel stuck in the past, buried in manual work? Identifying these high-friction points gives you a solid, value-driven starting point for your AI strategy.

Charting a Course with a Proof of Concept

Once you have a few potential use cases in mind, the next move is to find a technology partner who’s been down this road before. Working with an experienced AI solutions partner is critical for turning your business goals into a technical reality that actually works and can grow with you. They’ll help you wrestle with the tough stuff—data prep, model selection, and integration.

A discovery workshop or a proof-of-concept (POC) is the perfect way to kick things off. A POC lets you test an AI solution on a small, manageable scale. You can validate its potential and build a strong business case for a bigger investment. It’s a low-risk, high-learning approach that lets you start your transformation with confidence.

A well-executed POC does more than just prove the tech works. It builds crucial momentum and gets people on board across the company. It turns the abstract idea of “AI” into a tangible result that stakeholders can see, touch, and get excited about.

Your Path Forward to Implementation

Taking these initial steps puts you on a clear path to getting real value from AI for your business. The journey usually looks something like this:

- Identify High-Impact Use Cases: Go for the low-hanging fruit first. Pick problems that offer the clearest and quickest return, like automating initial claims validation or beefing up your fraud detection algorithms.

- Launch a Pilot Project: Team up with specialists in custom software development to build a focused solution that nails your chosen pain point.

- Measure and Iterate: Use the metrics from your pilot—like the ones we track in our real-world client cases—to fine-tune the solution and plan your next move.

- Scale with Confidence: With hard data and a proven model in hand, you can start expanding your AI capabilities to other parts of the business, building a competitive advantage that grows over time.

This structured approach ensures your investment in insurance software solutions and AI development services delivers strategic value that lasts.

Frequently Asked Questions about AI Integration in Insurance

Where should our insurance company start with AI?

The best approach is to start small and focused. Identify a single, high-friction business problem, such as slow claims approvals or manual underwriting tasks. Ensure you have clean, accessible data related to that problem. Then, partner with an AI development services team to launch a pilot project. A successful pilot delivers quick, measurable value and builds organizational buy-in for future initiatives.

Is AI going to replace our people?

AI is designed to augment your human workforce, not replace it. It excels at handling repetitive, data-intensive tasks, which frees up your experts to focus on complex, high-value work that requires strategic thinking, creativity, and empathy. For example, AI can automate data collection for underwriters, giving them more time to analyze nuanced risks and make critical judgment calls.

How do we make sure our AI models are fair and not biased?

Ensuring fairness is a critical responsibility. The key is to build a governance framework from the start, which includes:

- Using Diverse Training Data: Train your models on datasets that accurately represent your entire customer base to prevent skewed outcomes.

- Implementing Explainable AI (XAI): Avoid “black box” algorithms. Use XAI tools to understand and justify why a model made a specific decision, ensuring transparency for audits and customer inquiries.

- Maintaining Human Oversight: For critical decisions like denying a claim, always keep a human in the loop to review and override the AI’s recommendation when necessary. Working with an experienced AI solutions partner ensures these ethical guardrails are built in from day one.

What is the typical ROI for AI integration in insurance?

The ROI can be significant and multifaceted. Operationally, insurers report a 20-40% reduction in customer onboarding costs and a 3-5% improvement in claims accuracy. Financially, this can translate to 10-15% premium growth and a major reduction in fraudulent payouts. Beyond the numbers, AI enhances customer satisfaction and retention, creating long-term value that strengthens your competitive advantage.

Ready to see what AI can really do for your insurance operations? Bridge Global offers the expert guidance and development firepower to help you move forward with confidence. Schedule a consultation today to explore your AI advantage.